Technology is the catalyst that has been expediting the evolution of different businesses. Software and systems that used to be a luxury and additives for businesses are now considered a necessity. Without them, a business might not be able to keep pace with the competition, and that’s not the worst of it. Since technology has permeated every sector and every aspect of different industries, it has also become necessary for Governance, Risk, and Compliance or GRC.

For financial institutions in the region, Singapore’s Payment Services Act is a reminder of how tech-based transactions (e-money, digital payments, crypto, etc.) are being regulated and how they should improve their GRC program (or start one from scratch) to ensure proper compliance.

Singapore’s Payment Services Act

Thanks to its positive attitude towards crypto and being one of the most tech-savvy nationals, Singapore has made some powerful strides toward fintech providing payment services and the evolution of banking. According to a Deloitte report on the topic of Singapore’s Payment Service Act, five factors have been impacting the changing payment landscape (and, by extension, financial service companies, and banking) in Singapore: Transforming payment technologies, new payment services, e-commerce boom, payment activity convergence, and smartphone penetration.

This means for relevant businesses is the GRC implication of this newly evolving payment landscape, in which Singapore’s payment service act plays a very important role. The act is a major leap forward and offers a comprehensive framework that accounts for e-payment services, digital payments, and crypto-currency, which hasn’t been universally adopted. It can create a slew of risk and compliance issues for a business that’s not properly prepared.

Take crypto, for example. While it might be considered illegal in some countries and is treated (and taxed) as “property” and not as currency, Singapore’s Payment Services Act allows crypto platforms to obtain licensing, which would ensure their regulatory compliance. But it is still a problem for cross-border trade, thanks to the arbitrary treatment of crypto and some other digital payment methods by different countries. This makes tackling the whole GRC trio even more complicated.

Still, the act is a step in the right direction. It’s not only expected to improve the country’s payment landscape but by being on the frontline of this change, which will eventually become global (most likely), Singapore’s relevant financial institutions and businesses that make the relevant GRC changes and work through the complications might get an early bird advantage.

But they don’t have to do it on their own, and they can leverage technological advances to deal with the GRC issues that might arise as a result of this act. By working with the right industry experts, a business can find the right GRC solutions and start adopting and facilitating future-facing payment methods. And that’s where Surestep Systems Integration comes in.

How Does The Right System and Company Help?

If you are running a payment service business or your existing business models need to update their payment methods to meet the changing demand of your customers and clientele, you need to familiarize yourself with Singapore’s Payment Services Act.

That means its compliance, regulations that you’d have to follow, and risk associated with the change. This might not be the most exciting software and system implementation you’d oversee as a business owner, but it’s necessary.

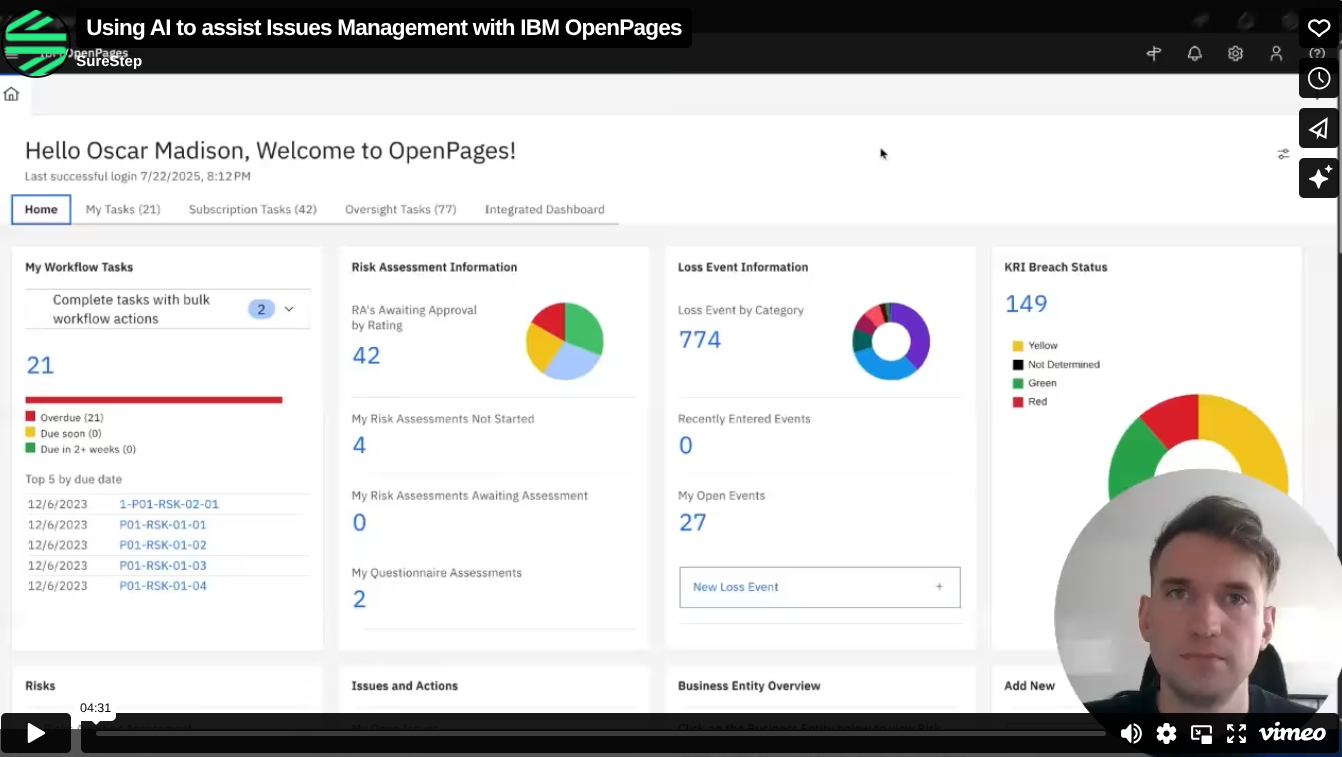

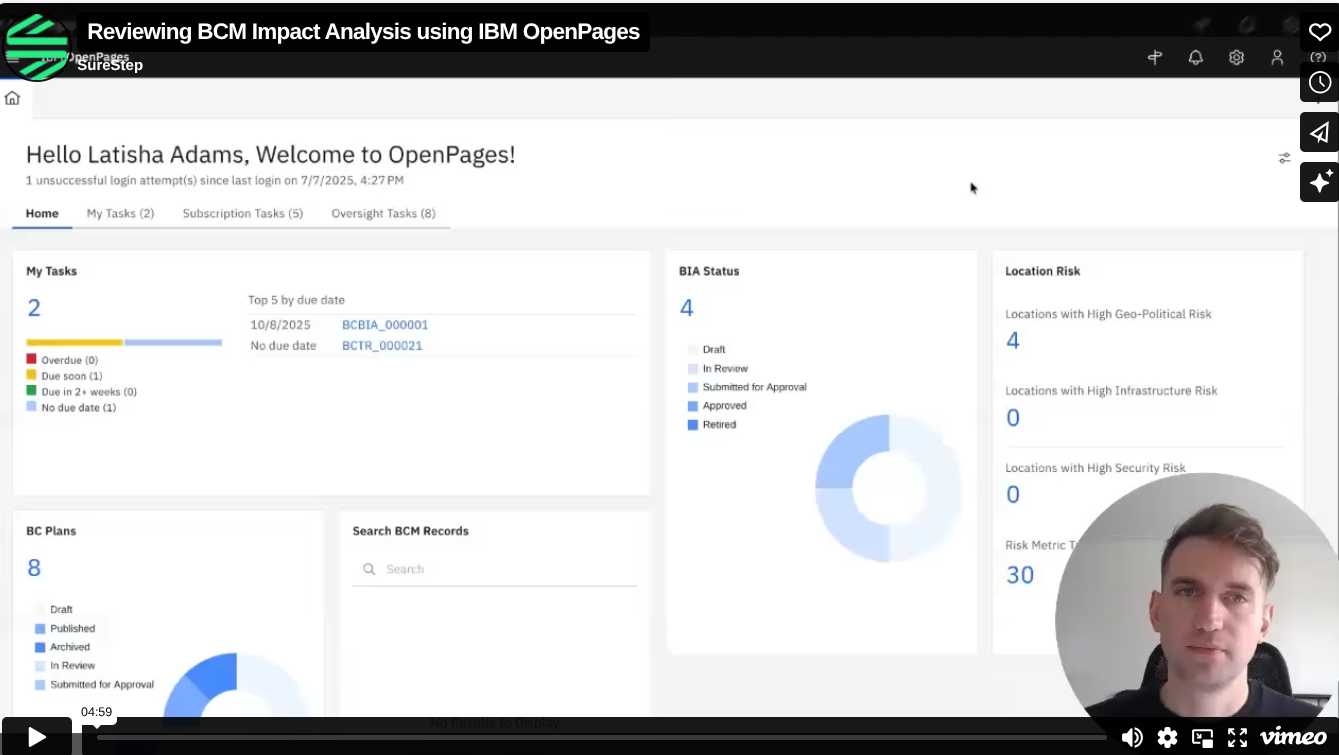

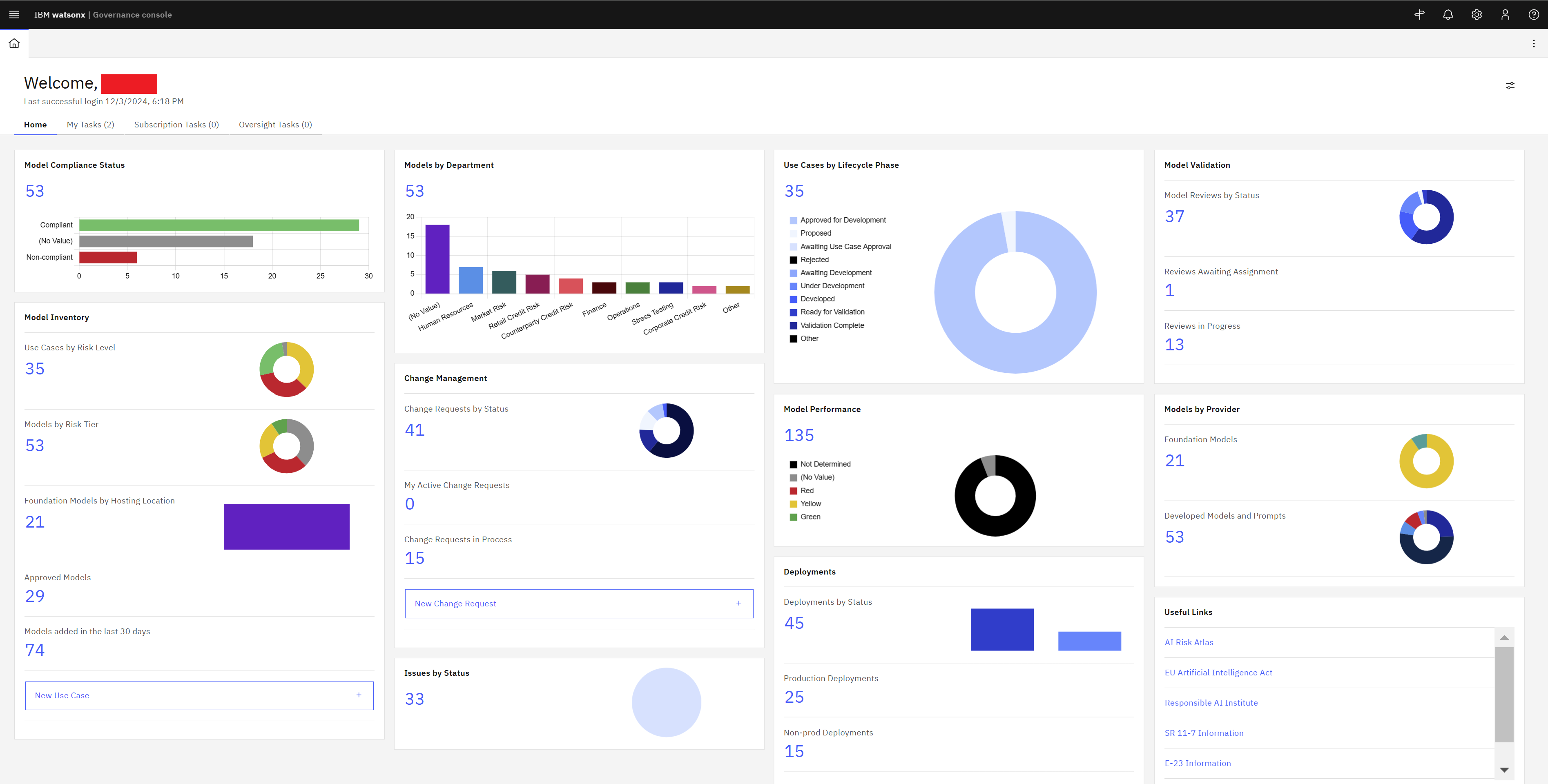

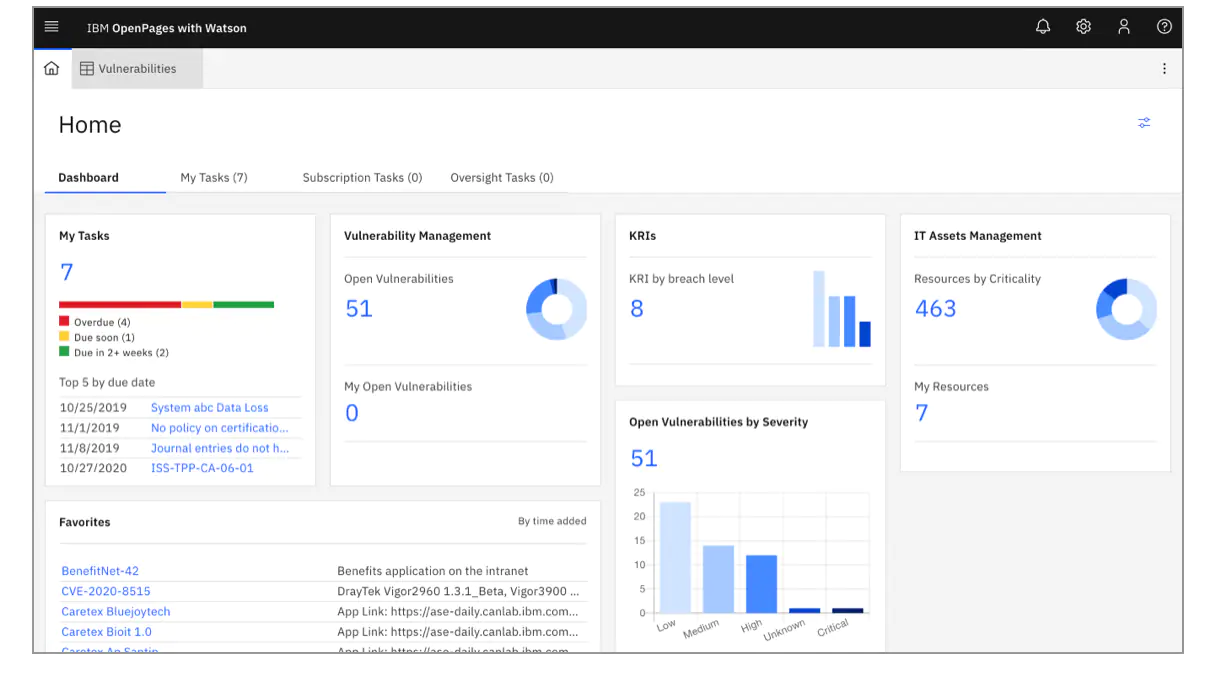

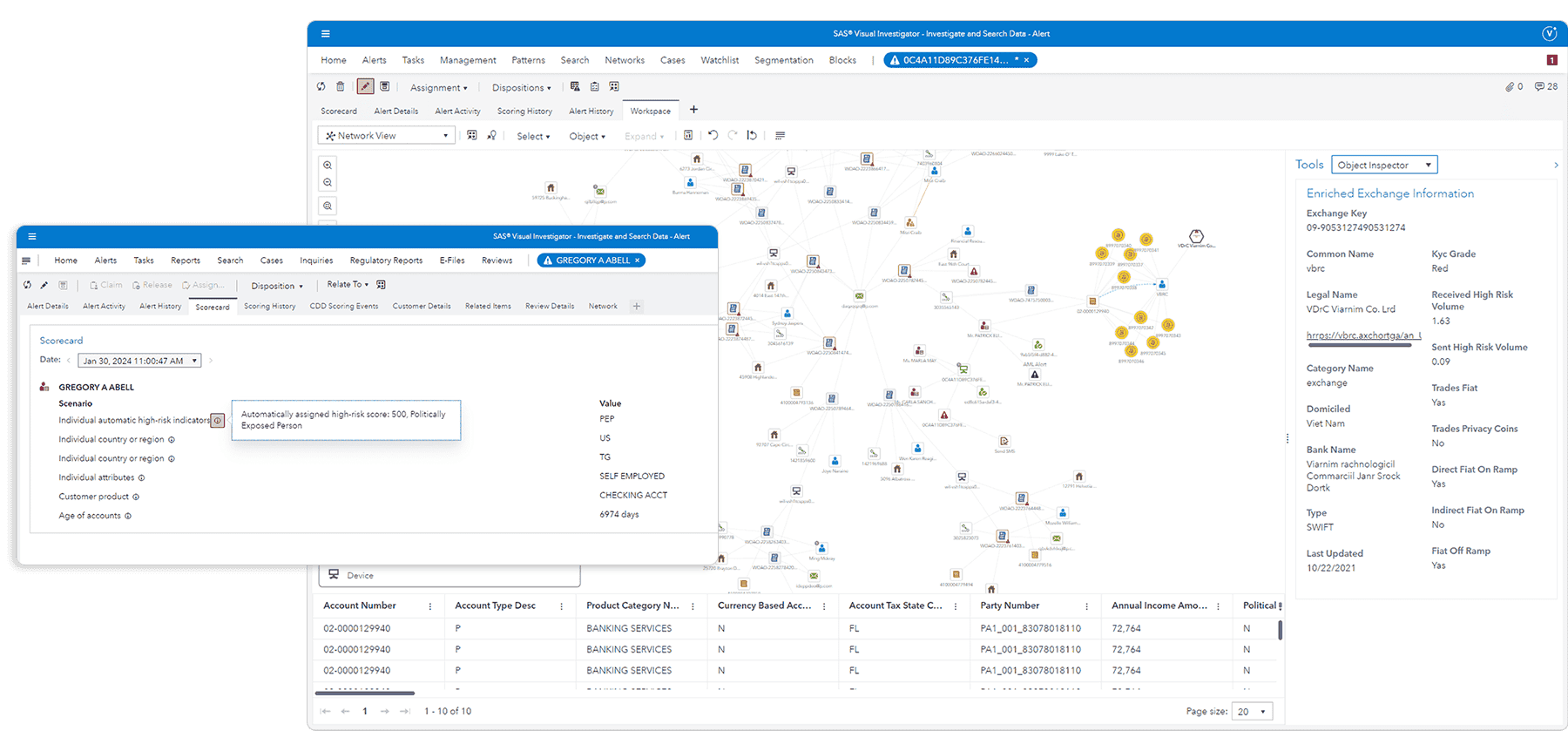

Surestep specializes in implementing risk and compliance systems around the globe. One distinction to note about the company (and similar companies) is that they only provide the GRC systems. They don’t offer legal consulting or compliance itself. But the system they provide helps you take care and stay ahead of regulatory compliance issues.

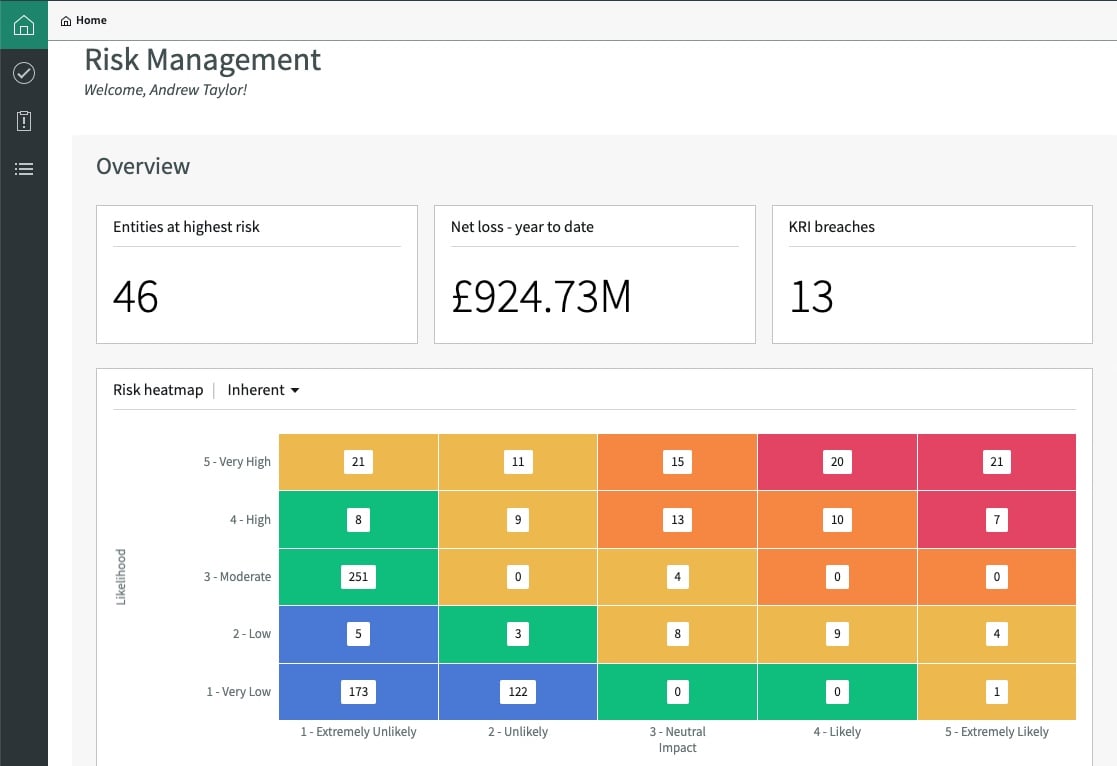

With the right system in place, you’ll be able to stay ahead of any compliance issues you might run into and possible financial penalties. This makes such systems equally important as systems that are placed on improving productivity and profitability, or in some cases, even more so. Because even if their ROI isn’t tied directly to their revenue generation, failing to put such systems in place can result in penalties and fines, and possible restrictions that can lead to the permanent loss of business.

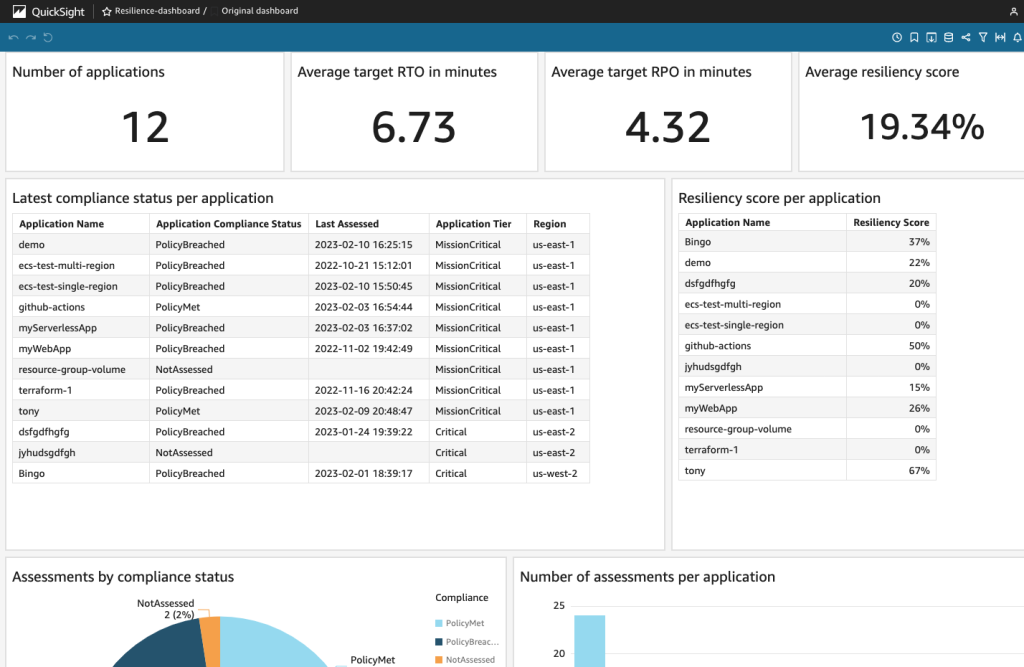

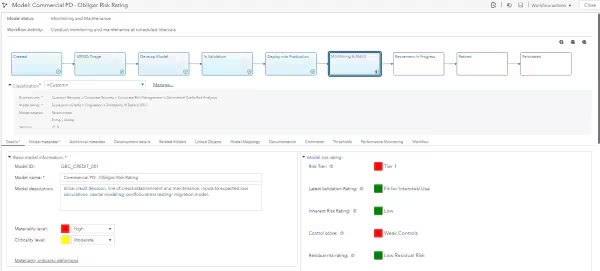

Based on your business model and your existing GRC implementation, you will need to make a choice between different GRC solutions. You might need a foundational GRC software solution covering all aspects of your business (including compliance regarding payment methods and relevant regulations) and helping you control risk across the board.

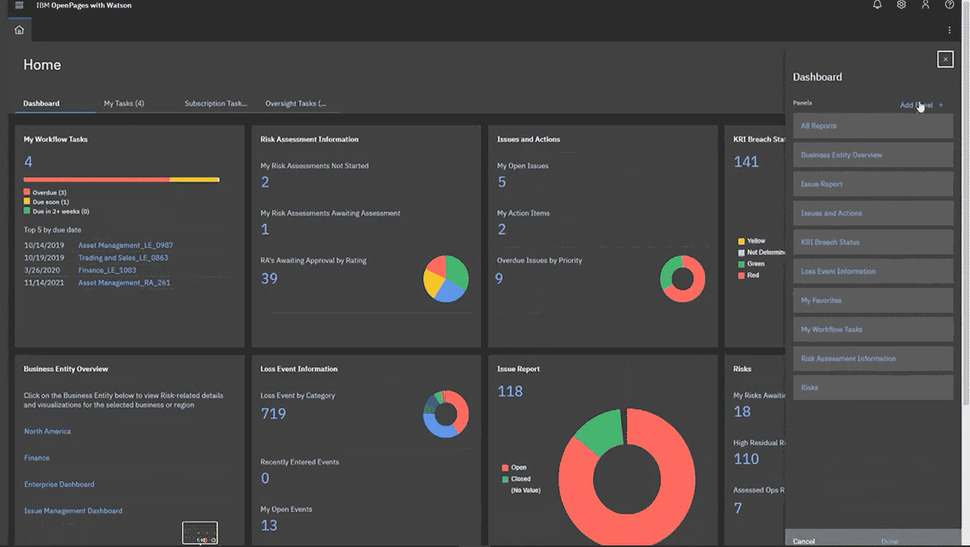

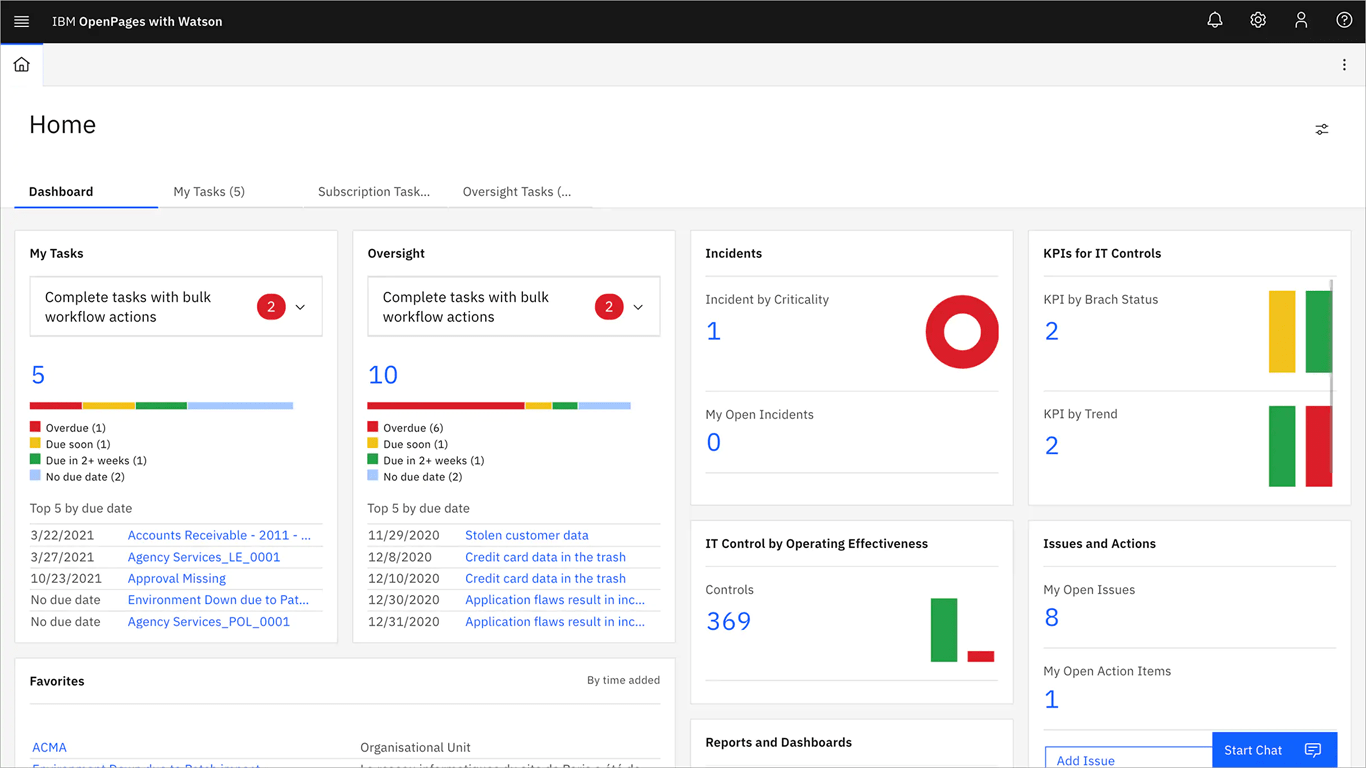

That might require you to adopt a solution like IBM OpenPages or ServiceNow GRC and VRM. If you aren’t looking (or don’t need) to invest in such a comprehensive solution, a targeted GRC solution like regulatory compliance management can help you with regulations and licensing issues that you might face in light of Singapore’s Payment Services Act.

But even the best software and solution is only as good as its implementation and adoption. That’s why working with the right partner for your GRC solution is so important. They might not be able to consult you on the legal and compliance issues per se, but offering thorough software consultancy around process management will help you maintain compliance either way. The earlier you implement such a solution, the lesser your risk of running into any payment-related compliance issues would be.

Conclusion

Payment methods are evolving to become faster and more efficient in the wake of the e-commerce boom. This requires payment service providers to adapt accordingly. Singapore’s Payment Services Act can be a boon to many financial businesses that are well-positioned to facilitate the much-needed and forward-facing payment options.

But in order to capitalize fully on this opportunity, businesses need to ensure that they are equipped to comply with the regulations and have the right GRC system and solutions in place. If you are running a FinTech company that offers financial services that include or rely upon new payment options, you might need to revamp your GRC program or get a new robust GRC system to stay ahead of the curve.

.webp)

-1.jpg)

.jpg)

.jpeg)